The new tax law, effective January 1st, prompted a lot of conversation about deductions and tax brackets. Lost in the discussion has been the wide variety of other benefits that lead donors to make a charitable gift in a particular way.

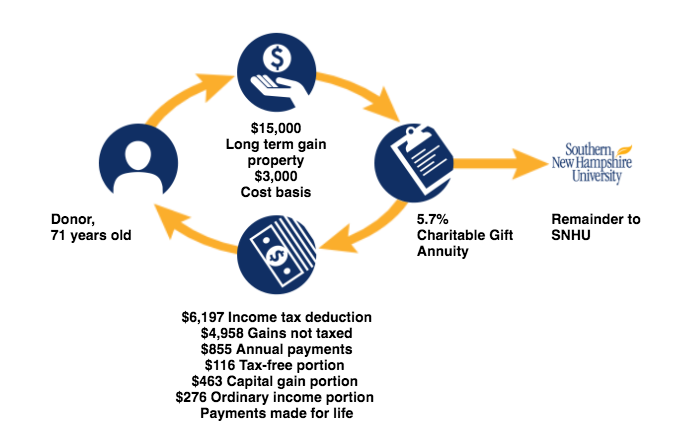

Take a charitable gift annuity, an arrangement whereby in exchange for a contribution Southern New Hampshire University agrees to make fixed payments for life to one or two annuitants – most commonly the donor(s), though it doesn’t have to be. The amount paid is based on the age of the person(s) receiving the payments.

Payments can be deferred to a specified date if you have sufficient income now but want to supplement your cash flow later in life. The new - and higher - annuity rates can help ensure a comfortable retirement.

When contributing for a gift annuity you receive an immediate income tax charitable deduction. If you will be itemizing your deductions on your tax filings, you will realize tax savings from your charitable deduction.

But many donors find the other benefits of a gift annuity to be of equal or greater value. What are those?

- Increased cash flow - Common assets used to fund a gift annuity are from savings, CDs, or long term appreciated stock. What quality do they share? They are usually not generating much in interest or dividends. While in making the contribution you are giving away the asset, the cash flow from that asset likely will increase significantly.

- Tax free payments - When cash is contributed, the payments received from a gift annuity will be part tax-free and part ordinary income. The tax-free portion lasts for a period of years, determined by your life expectancy at the time the gift is made.

- Capital gains tax avoidance/deferral - When long term appreciated stock is contributed, some of the capital gain – the portion attributable to the charitable gift being made – is avoided. An added benefit, if the donor is the annuitant, is that the capital gain included as part of the payment stream is taxed over the donor’s life expectancy, rather than upfront in the year in which the stock is contributed.

You can create a customized illustration of how a gift annuity could benefit you by going to our website at plannedgiving.snhu.edu and learn what potential income you could receive. We’d also be glad to talk with you about gift options that can provide other benefits that might allow you to best align your charitable, financial, and estate planning goals.